About Hard Money Atlanta

Wiki Article

The Best Guide To Hard Money Atlanta

Table of ContentsThe smart Trick of Hard Money Atlanta That Nobody is Talking AboutThe Of Hard Money AtlantaNot known Factual Statements About Hard Money Atlanta What Does Hard Money Atlanta Mean?The Basic Principles Of Hard Money Atlanta

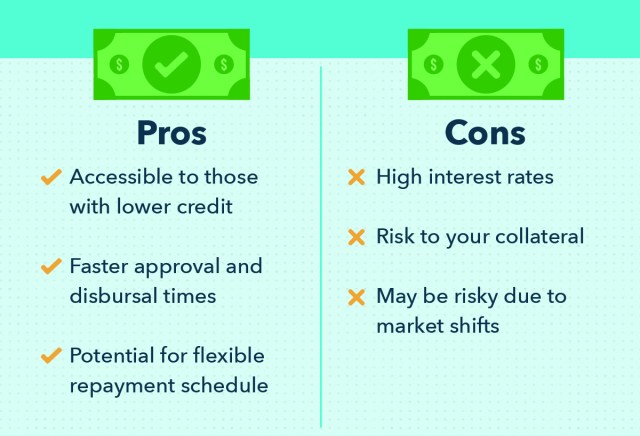

In a lot of areas, passion rates on tough money lendings run from 10% to 15%. Furthermore, a consumer might require to pay 3 to 5 factors, based on the total financing amount, plus any relevant evaluation, evaluation, and also administrative charges. Lots of difficult cash lending institutions require interest-only settlements throughout the brief duration of the funding. hard money atlanta.Tough cash lenders make their money from the interest, factors, and also charges credited the borrower. These lenders seek to make a quick turnaround on their investment, therefore the higher rate of interest as well as much shorter terms of tough money fundings. A hard cash finance is a good suggestion if a debtor needs cash swiftly to buy a residential property that can be rehabbed as well as turned, or rehabbed, rented and re-financed in a relatively brief period of time.

The Buzz on Hard Money Atlanta

For personal financiers, the most effective component of getting a tough money financing is that it is less complex than getting a conventional mortgage from a financial institution. The authorization process is normally a lot less intense. Financial institutions can request for an almost unlimited series of files as well as take a number of weeks to months to obtain a financing accepted.The major function is to see to it the customer has an exit strategy and isn't in economic spoil. Yet lots of hard money lending institutions will certainly work with people that don't have fantastic credit report, as this isn't their most significant issue. One of the most essential point difficult money lending institutions will consider is the investment residential or commercial property itself.

Hard Money Atlanta - An Overview

There is another benefit constructed right into this procedure: You obtain a 2nd collection of eyes on your offer as well as one that is materially spent in the job's result at Clicking Here that! If an offer misbehaves, you can be relatively positive that a hard money lender will not touch it. You should never ever make use of that as a reason to abandon your own due diligence.The most effective area to try to find difficult money lenders remains in the Larger, Pockets Difficult Money Lending Institution Directory Site or your regional Real Estate Investors Organization. Bear in mind, if they've done right by another capitalist, they are most likely to do right by you.

Continue reading as we discuss tough cash fundings and why they are such an eye-catching choice for fix-and-flip investor. One significant benefit of tough money for a fix-and-flip investor is leveraging a relied on lender's reliable resources as well as rate. Leveraging ways using various other people's cash for investment. Although there is a threat to financing an acquisition, you can maximize your very own money to acquire more properties.

The Buzz on Hard Money Atlanta

You can handle tasks incrementally with these strategic car loans that enable you to rehab with simply 10 - 30% down (relying on the lending institution). Tough cash lendings are usually short-term finances made use of by actual estate capitalists to money solution and also flip properties or other realty financial investment bargains. The property itself is used as security for the funding, as well as the high quality of the genuine estate deal is, therefore, more vital than the borrower's credit reliability when certifying for the finance.Nonetheless, web link this likewise implies that the risk is greater on these finances, so the rate of interest are usually greater as well. Repair and also my site flip investors pick difficult cash since the market does not wait. When the opportunity emerges, as well as you're ready to obtain your project right into the rehab stage, a difficult cash funding gets you the money straightaway, pending a fair evaluation of business bargain.

But inevitably, your terms will rely on the hard cash lender you select to work with as well as your unique scenarios. Below's a listing of typical demands or credentials. Geographic location. A lot of hard money lending institutions run in your area or only in particular regions. Nonetheless, several operate across the country, Kiavi currently offers in 32 states + DC (and counting!).

Hard Money Atlanta for Dummies

Intent and home paperwork includes your comprehensive scope of job (SOW) and also insurance policy (hard money atlanta). To examine the residential property, your loan provider will look at the worth of equivalent residential properties in the location and their projections for development. Complying with an estimate of the property's ARV, they will certainly money an agreed-upon percentage of that worth.This is where your Range of Work (SOW) enters into play. Your SOW is a paper that details the job you mean to carry out at the residential or commercial property and also is normally needed by most difficult money lending institutions. It includes renovation expenses, responsibilities of the events involved, and also, typically, a timeline of the deliverables.

Let's presume that your residential property doesn't have a finished basement, but you are planning to finish it per your extent of work. Your ARV will be based upon the marketed rates of equivalent homes with completed cellars. Those costs are most likely to be higher than those of residences without ended up cellars, thus enhancing your ARV as well as possibly certifying you for a higher financing quantity. hard money atlanta.

Report this wiki page